New Challenges Emerged

The world emerged from a once-in-a-century global pandemic only to enter an unprecedented polycrisis that weighed on consumer sentiment and had a ripple effect on spending in the second half of 2022.

inflation & rising Rates

labor shortages

war

climate disasters

demand peak

endemic

Adjusting to New Crosscurrents

"The good news is that abrupt changes can be healthy, their swiftness is helpful in resetting expectations."

Aryeh B. Bourkoff, CEO, Lion Tree

return to experiences

digital detox

nurturing communities

influencer ECONOMY

nostalgia

esg & dei

The Great Retail Reset Continued

Consumers shifted their buying behaviors for the post-pandemic era forcing retailers to adapt again and cater to shoppers who traded down and pulled back on spending in the face of economic concerns.

71%

of consumers expect personalized interactions

74%

of executives expected labor shortages

90%

of the world's merchandise shipped by sea

CONSUMERS

Emotional to responsible spending

Personalization and loyalty

Payment flexibility

Path to purchase is URL and IRL

RETAILERS

Cost and inventory pressures, discounting

War for talent and reskilling

Data privacy

Retail Media Networks

SUPPLY CHAIN

Ongoing logistics disruptions

Production delays

Inflation pricing

Technology - data and tools

Source: McKinsey, Deloitte, WSJ, Shipping solutions

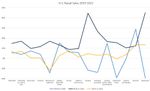

Retail Sales Category Growth 2019 - 2022

Retail's remarkable run through the pandemic began to slow in 2022 as consumers traded down and pulled back spending in the face of four-decade high inflation and economic uncertainty.

Source: US Census Retail Sales, MARTS seasonally adjusted, 2021.

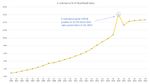

E-commerce Sales

Brick-and-mortar retail recaptured market share from the record e-commerce growth surge during the height of the pandemic.

Source: U.S. Census Bureau Est. Quarterly E-commerce Sales Q3 2021.

Retail Bankruptcies, Store Closures & Openings

Retailers' healthy balance sheets from 2021 carried over into the first half of 2022 and resulted in the lowest bankruptcy filings in over a decade with store closures outpaced by store openings.

BANKRUPTCIES & STORE CLOSURES

- Only a handful of U.S. retailers filed for bankruptcy in the U.S. in 2022 including Sears Hometown, Olympia Sports, Revlon, and Escada (US).

- Approximately 2,600 stores closures in 2022.

STORE OPENINGS & EXPANSIONS

- New concepts from traditional retailers such as Dollar General's Popshelf, alternative and service uses, health and wellness concepts, and DTC/DNB expansion lead store openings.

- Over 5,100 stores opened in 2022.

Source: Coresight Research, BDO, UBS

Retail Property Trends

In 2022, retail properties across all segments exceeded 2019 traffic, sales, occupancy, and rent collections. Cyclical market adjustments due to the rising cost of capital resulted in fewer deal counts and total sales volume in the second half of the year.

Malls

- Most bifurcated segment of retail

- Bankruptcies, store closures and relocations slowed in 2022, but vulnerability remains in B and C malls

- Wholesale redefinition of the mall format and anchor tenants

- Optimization and densification of the underlying real estate

Urban Core & Street Retail

- Divided recoveries among the urban core in major U.S. cities

- Urban recovery predicated on return to office or adaptive reuse

- Suburban street retail had the strongest recovery

- Business closures were absorbed by expanding retailers, restaurants and entrepreneurs

Power Centers & Outlets

- Health varies by asset and vacancy exposure

- Big-box closures represent either a challenging demise or opportunistic revival

- Value-oriented outlets and big box driving traffic and sales

- Outlets captured value-oriented shoppers, but risk exposure may rise as consumers trade down further

Mixed-Use & Lifestyle

- Resilient open-air centers remained strong

- Indoor mall tenants migrated off-mall to outdoor centers expanding merchandising opportunities

- Densification with diverse uses across multiple day-part uses

- Outdoor space as the new anchor - maximizing, activating public spaces to drive traffic and NOI

Grocery-Anchored, Neighborhood

- E-commerce and recession proof

- Recovered services enhance essentials to drive traffic and sales

- Permanent expansion of curbside, drive thru

- Strongest investor confidence, but trading volume down due to cost of debt and pricing

Source: Madison Marquette Retail Services, MSCI Real Capital Analytics, Datex Property Solutions